Tower Staking simplifies staking digital assets through a three-step process: register, delegate assets using AI technology, and claim rewards based on chosen business plans.

Boasting complete automation, the platform assures partners that maintenance is handled seamlessly.

However, as we explore Tower Staking, concerns arise regarding transparency, ownership, and the legitimacy of returns, prompting a closer examination of credibility and potential risks.

Note:

You can think of this review as a helpful guide that you can use when assessing different platforms that promise to help you make money online.

If you come across a platform or website that you want to learn more about, you have a couple of options:

– You can use the search button on my website to see if I’ve already reviewed it, or

– You can leave a comment, and I’ll do my best to provide feedback within 24 hours.

Jump to:

- What Is Tower Staking?

- Who is Behind Tower Staking?

- What Are The Tower Staking Products?

- How to Make Money with Tower Staking?

- How to Contact Tower Staking?

- Tower Staking Red Flags

- Tower Staking Reviews

- Tower Staking Pros & Cons

- Conclusion

Disclaimer

Please note, that I am not a member or an affiliate of Tower Staking.

This review is based on research and online information in the public domain.

Any recommendations and conclusions are only opinions and may not apply to all persons or situations.

Tower Staking Overview

Name: Tower Staking

Website: towerstaking.com – website shut down (as of March 21st, 2024)

Price to Join: Free to Join. Minimum to invest $250.

Recommended: No!

Tower Staking claims big with quantum AI, promising up to 60% monthly returns.

However, red flags abound – no ownership details, dubious compensation plans, and unverified revenue claims.

The platform’s lack of transparency raises doubts about its legitimacy.

The table below outlines critical details such as the registration date, domain authority, and the platform’s approach to generating returns.

The information presented serves as a quick reference guide for individuals considering involvement with Tower Staking.

| Category | Information |

|---|---|

| Registration Date | July 18, 2023 |

| Domain Authority | Extremely Low – 5/100 |

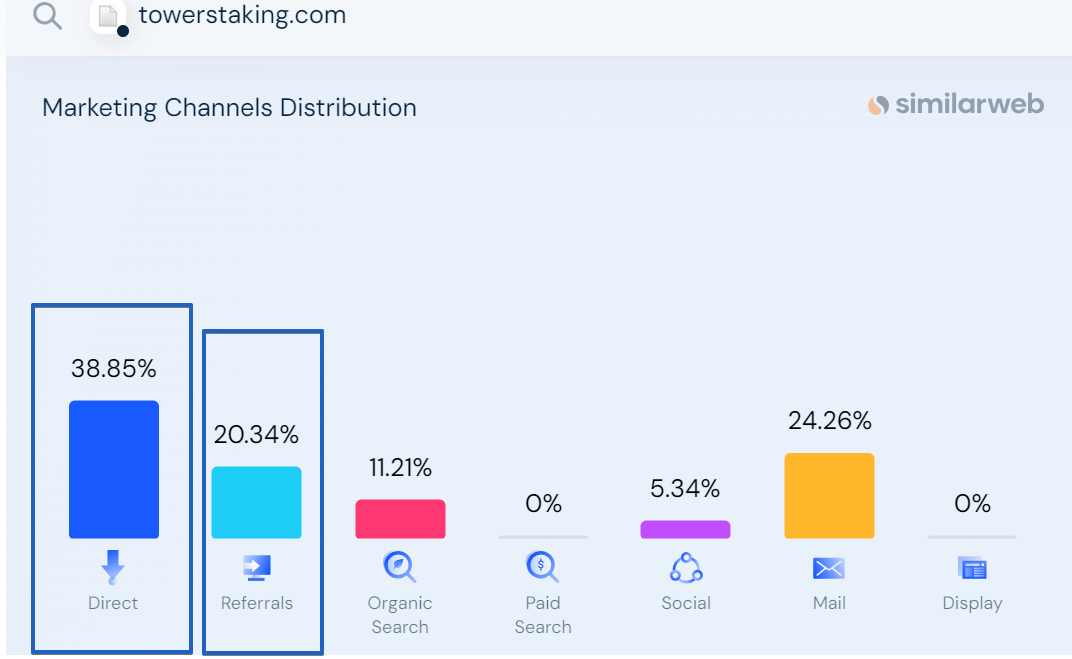

| Traffic Sources | Mainly Direct and Referral |

| Products/Services | No tangible products or services |

| Revenue Source | Unclear – Potential emphasis on recruitment |

| Monthly Returns | Advertised up to 60% |

| CEO/Founder Information | Unavailable |

| Transparency Concerns | Lack of information about operations and profits |

What Is Tower Staking?

Tower Staking is a platform where you can lock up your digital assets to help secure a network and, in return, get rewards.

It’s like putting your money in a special savings account that uses advanced technology to automatically manage everything for you.

However, the promise of limitless potential with zero financial loss, coupled with returns of up to 60% monthly, seems rather ambitious and raises skepticism about its feasibility.

Claiming a consistent 60% monthly return on investments is usually seen as unrealistic and could be a sign of potential risks or a risky investment scheme.

Tower Staking Website Information

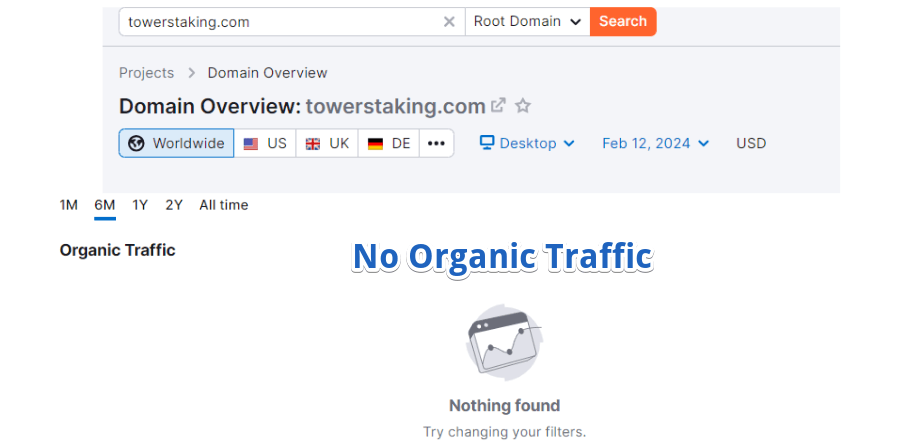

Tower Staking’s website presents some notable characteristics when analyzed.

As per Ahrefs, the domain authority is remarkably low, standing at just 5 out of 100. Despite

Being registered since July 18, 2023, the website exhibits minimal organic traffic, raising questions about its visibility and online presence.

The majority of the observed traffic is categorized as direct and referral, hinting at a potential reliance on recruitment strategies for user acquisition.

The low domain authority, minimal organic traffic, and dependence on direct and referral sources indicate potential concerns with Tower Staking’s online platform

Who is Behind Tower Staking?

It’s a bit of a mystery – we don’t know who the CEO or founder is, and there’s no info about the team either.

If you compare it to platforms like Bybit, they’re upfront about their CEO, and you can find that info easily with a quick search.

Tower Staking, on the other hand, doesn’t give us much to go on.

This lack of info about the people running things raises some questions about how reliable and legitimate the platform is.

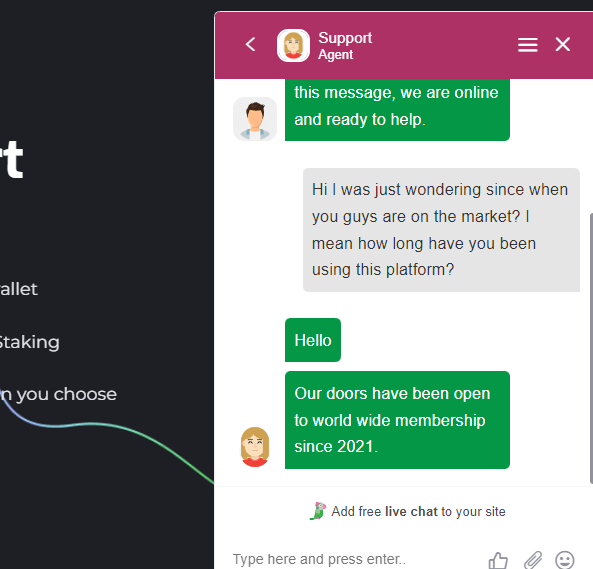

That’s why I decided to get in touch with them using their chat button at the bottom right. I was pleasantly surprised that there is a real person I can communicate with.

After a few questions, they provided me with the TowerStake presentation, where they mentioned their CEO, Mr. Simon Schmitt.

I dug a bit deeper, but I was not able to find any information regarding the name Simon Schmitt in relation to TowerStake.

Typically, individuals like him, especially when they have been operating for years, are usually easy to find on LinkedIn or other platforms that highlight their position and the platform’s credibility.

In this case, it doesn’t seem so.

What Are The Tower Staking Products?

Tower Staking doesn’t actually have any real products or services to offer.

No products at all.

This might make you wonder about the value of getting involved.

Plus, there’s no proof of where your money goes or how they make those promised high returns.

How to Make Money with Tower Staking?

In theory, and according to their website, to make money with Tower Staking, individuals typically follow a three-step process:

- Register and Send Coins to a Wallet: Start by signing up on the Tower Staking platform and transferring your chosen digital assets to a designated wallet.

- Connect & Delegate to Tower Staking: Once registered, connect your wallet to the Tower Staking platform and delegate your digital assets. This involves locking up your assets to contribute to a Proof-of-Stake network.

- Claim Rewards: Depending on the chosen business plan, users can claim rewards periodically. Tower Staking promises passive returns, emphasizing an automated system run by AI technology, allowing users to earn without actively managing their portfolios.

But, it’s important to be careful and think about if it’s the right choice.

There are worries about how clear and honest Tower Staking is about what they do, how real they are, and if they can really give you the returns they promise.

Based on my research and the information shared, it appears that making money with Tower Staking mainly involves bringing in new people.

The focus seems to be on recruitment rather than actual investments or profits.

So, keep this in mind before deciding to get involved.

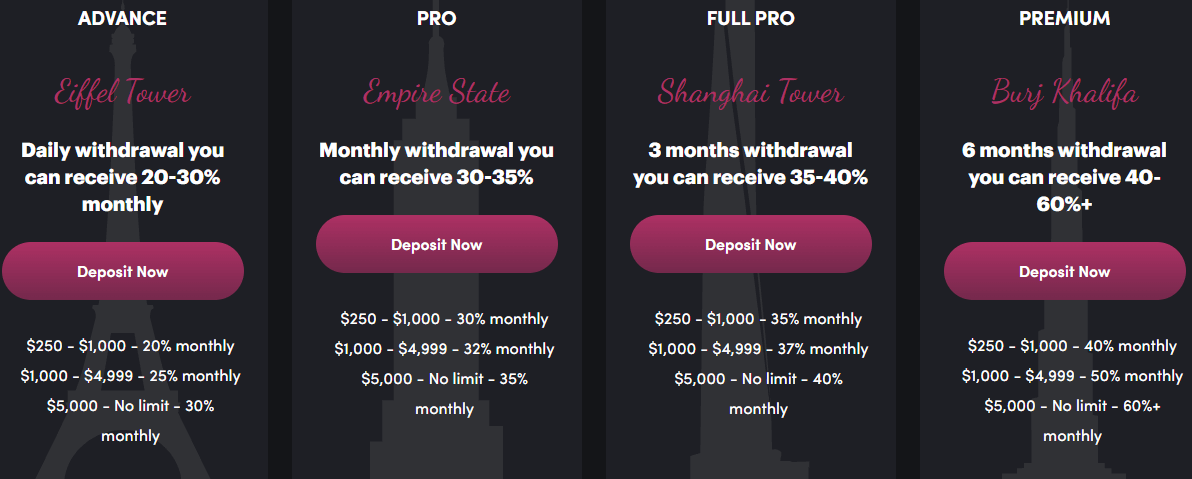

Tower Staking Investment Plans Overview

| Investment Plan | Investment Amount | Monthly Returns |

|---|---|---|

| Advance / Eiffel Tower (Daily Withdrawals) | $250 – $1000 | 20% |

| $1000 – $4999 | 25% | |

| $5000 or more | 30% | |

| Pro / Empire State (Withdrawal Once a Month) | $250 – $1000 | 30% |

| $1000 – $4999 | 32% | |

| $5000 or more | 35% | |

| Full Pro / Shanghai Tower (Withdrawal Once Every 3 Months) | $250 – $1000 | 35% |

| $1000 – $4999 | 37% | |

| $5000 or more | 40% | |

| Premium / Burj Khalifa (Withdrawal Once Every 6 Months) | $250 – $1000 | 40% |

| $1000 – $4999 | 50% | |

| $5000 or more | 60% |

The monthly returns they promise, like 20% to 60%, seem really high. In regular investments, these kinds of returns are usually not seen.

How to Contact Tower Staking?

When assessing the legitimacy of a platform like Tower Staking, reaching out to them is a smart move.

A genuine and timely response within 24 hours can be a positive indicator.

Visit their website, check the About or Contact page, and either use the contact form or find their email to send a brief message.

Legitimate platforms usually provide responsive feedback.

In my experience with various platforms, the legit ones consistently respond.

However, with platforms like Tower Staking (or Tradixis, BFF Global Network), I didn’t receive any response.

Fortunately, with Tower Staking, I was able to contact them using the chat button.

The reply I got raised concerns, particularly when their registration date contradicts their claim of being around since 2021.

This inconsistency adds to doubts about the platform’s credibility.

Tower Staking Red Flags

Lack of Ownership Information

Tower Staking fails to provide ownership or executive information on its website.

Absence of Marketable Products

Tower Staking offers no Marketable products or services, with affiliates only able to market the affiliate membership itself.

Doubtful Earnings and Payment Plan

Tower Staking makes unverified claims about generating revenue through vague technologies, while its compensation plan, promising high monthly returns of up to 60%, raises doubts about the sustainability and legitimacy of the business model.

Referral-Based Revenue

Tower Staking relies heavily on new investments to pay affiliate withdrawals, exhibiting characteristics of a potential Ponzi scheme.

Lack of Transparency

The platform’s failure to offer verifiable evidence of external revenue and its business model not aligning with realistic investment returns raises transparency concerns.

Contradictory Information

Discrepancies between the registration date of the website and the platform’s claim of being around since 2021 create inconsistencies, further impacting the platform’s credibility.

Limited Communication

Despite efforts to contact the platform, the response received raises doubts about the transparency and honesty of Tower Staking.

Tower Staking Reviews

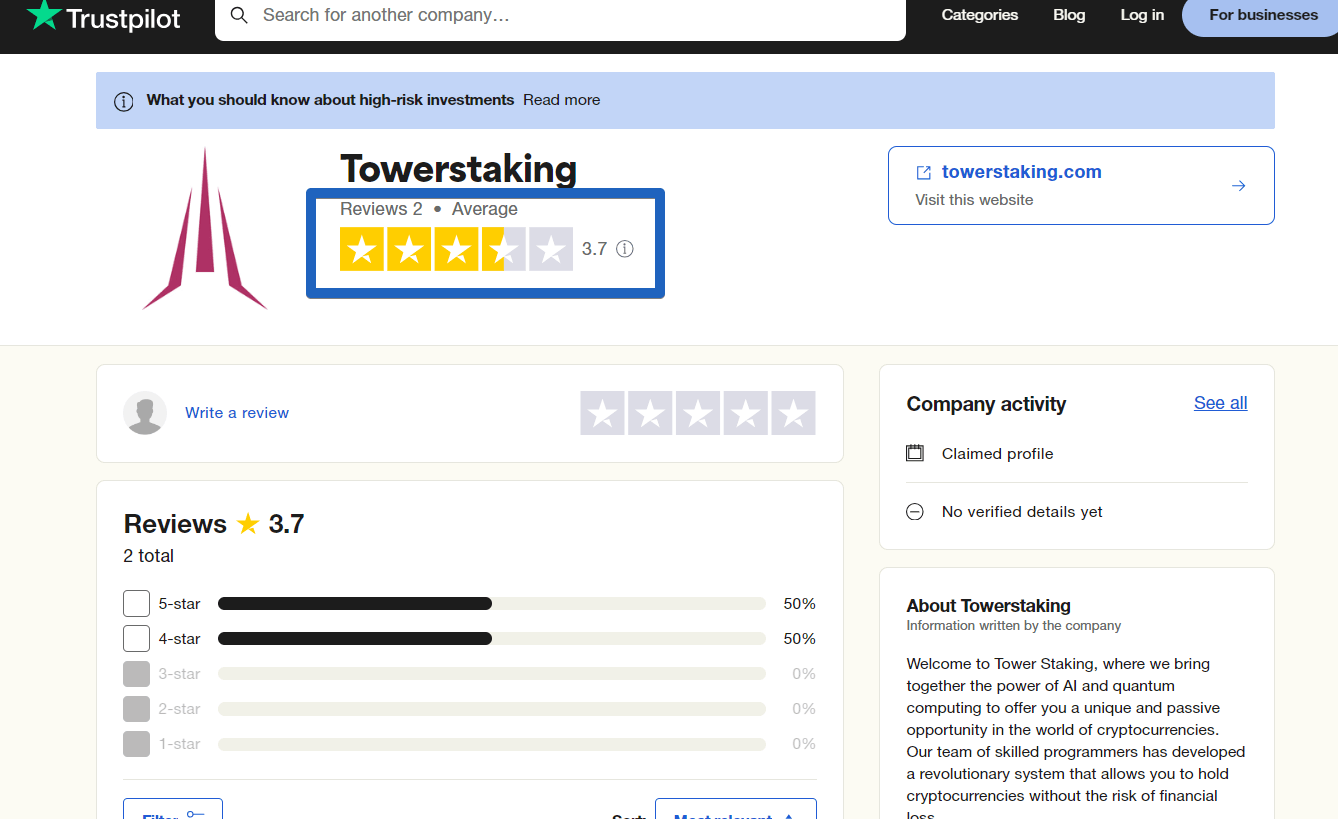

There are only two reviews on Trustpilot for Tower Staking, so it’s a bit tricky to rely on them completely.

Also, the reviews sound a bit like they’re trying to promote the platform rather than giving honest opinions.

Tower Staking Pros

User-Friendly Interface: The platform offers a straightforward and easy-to-navigate interface.

Responsive Support: Tower Staking was able to respond promptly using the chat button, indicating a level of customer support engagement.

(No feedback from other channels, though).

Tower Staking Cons

Promotional Tone: Some available reviews may sound more promotional than objective, potentially impacting the credibility of user opinions.

Limited Information: The lack of comprehensive information about ownership or company details may create uncertainty about the platform’s transparency.

Unsubstantiated Claims: There might be claims or promises on the platform that lack verifiable evidence, raising doubts about their legitimacy.

Potential Risks: Engaging with a platform with limited reviews and information poses potential risks, and users should exercise caution before investing.

Conclusion

Tower Staking talks big, claiming to be a cutting-edge AI platform with quantum powers to lure in investors.

They even promise crazy returns, like 60% per month, which sounds too good to be true – and usually is.

For folks familiar with investing, these kinds of claims set off alarm bells.

Adding to the concern, there are plenty of warning signs with Tower Staking.

From a lack of transparency to sketchy compensation plans and unproven income promises, it’s a risky deal.

In my opinion, it’s safer to steer clear of Tower Staking.

If you’ve had dealings with them or a similar platform, let me know your experience.

And if you see things differently, I’m open to discussion.

Thanks for reading, Mike

About the Author

Mike is an affiliate marketing analyst, content creator, and the founder of SetAffiliateBusiness.com.

Consistently producing in-depth and insightful articles. ??

Recent Posts

Business & Productivity Applications, Prompt Engineering

Market Research with AI: Competitor Analysis Prompts That Actually Work

Content Creation & Writing, Prompt Engineering

The Art of AI Editing: Prompts That Improve Your Existing Content

Content Creation & Writing, Prompt Engineering

Video Script Writing with AI: From Idea to Final Draft

Content Creation & Writing, Prompt Engineering

Long-Form Content Strategy: Prompting AI for 3000+ Word Articles

Content Creation & Writing, Prompt Engineering

Repurposing Content with AI: One Article, 20 Different Formats

Content Creation & Writing, Prompt Engineering